Why Choose Us?

A simpler way to pay

We make getting an education loan easy so that you can focus on what matters most, your education.

The benefit of tax saving

Tax deductions* that bring down your cost of financing.

Flexible repayment schedules

Repayment tenures of up to 15 years.

We cover it all

Up to 100% financing of tuition and cost of living.

Pan-India network of branches

Enjoy multi-city co-borrower(s) and collateral acceptance.

Friendly rates. All the way.

Customised interest rates that fit your need.

Dream big. Achieve bigger.

Exploring funding for larger education costs? Not a problem.

No hidden charges

What you see is what you pay.

*This is subject to restrictions imposed under the Income Tax Act, 1961 and Budget 2025.

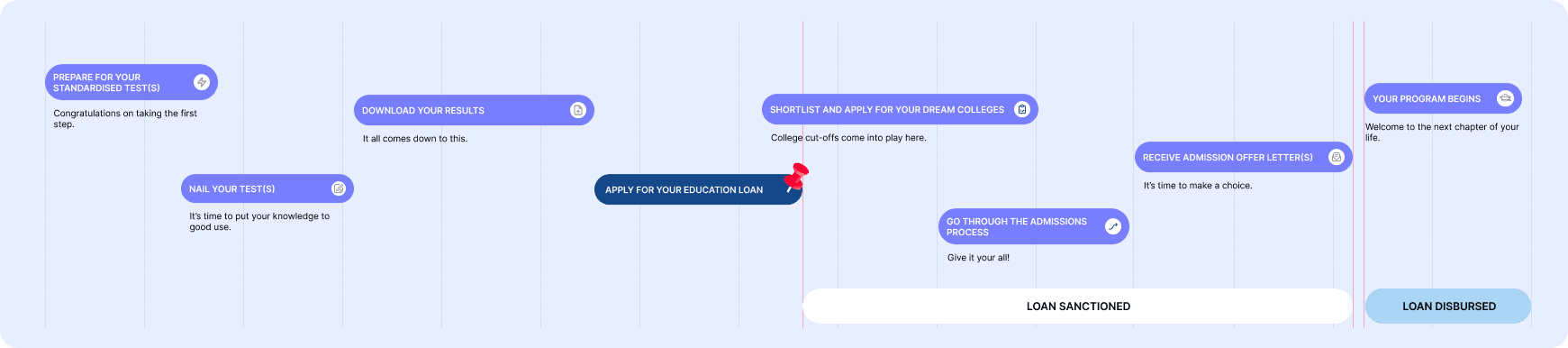

How to Apply For an Education Loan

Follow this 3-step process

1

1- Apply Online

Fill out the application form and upload documents.

2

2- Application Review

Get your sanction letter after our credit appraisal.

3

3- Funds Disbursed

You are all set to get started.

Paperless documentation

Documents required for an education loan application vary based on the borrower’s profile and the type of education loan the borrower applies for.

- Marksheet or Certificate for Grade 12 or equivalent.

- Marksheet or Certificate for the last semester/year/degree (e.g. B.E., B.Com., B.Sc. etc.).

- Scholarship Documents (if applicable).

- Salaried

- Latest 3 Salary Slips or Salary Certificate on employer’s letterhead.

- Latest one year’s Form 16 from the employer along with one year’s Income Tax Returns.

- Any other income proof that is not reflected in the above documents, viz., Rent Agreement etc.

- Self-Employed Professional

- Latest two years’ Income Tax Returns with I.T. acknowledgement.

- Latest two years’ Audited Financials of the Company including Computation of Income, Balance Sheet, P&L along with all the Schedules.

- 3CB & 3CD for Professionals with a turnover of more than INR 15 lakh and for others whose turnover is more than INR 60 lakh* .

Additional DocumentsIn addition to the above, the following documents are to be submitted- Proof of Establishment of the Firm (Shop Act, TIN No, Service Tax registration copy, SSI Certificate etc.).

- Copy of qualification or degree certificate.

- Self-Employed Non-Professional

- Latest two years’ Income Tax Returns with I.T. acknowledgement.

- Latest two years’ Audited Financials of the Company including Computation of Income, Balance Sheet, P&L along with all the Schedules.

- 3CB & 3CD for Professionals with a turnover of more than INR 15 lakh and for others whose turnover is more than INR 60 lakh* .

Additional DocumentsIn addition to the above, the following documents are to be submitted- For Proprietors: Proof of Establishment of the Firm (Shop Act, TIN No, Service Tax Registration Copy, SSI Certificate etc.)

- Partnership: Copy of Partnership deed.

- Private Company: Articles of Association (AoA), Memorandum of Association (MoA) and Shareholding Pattern Certified by the C.A.

- Salaried

- Latest six months Bank Statements are required where your salary is credited every month.

- Self-Employed Professional / Proprietorship/ Partnership / Private Limited Company

- Latest 8-month Current Account Bank Statement of the Bank Account where business receipts are credited every month.

- Latest eight months Saving Account Bank Statements.

- Any document to establish the relationship between the student and co-applicant, viz., Ration card, Marriage Certificate, Birth Certificate, School Leaving Certificate, etc

- Account Statement for loans or credit cards that had delays in payment (as proof of clarification).

- For students with past work experience, the last drawn salary slip.

- Proof of balance funds.

- Notes

- The audit report, duly signed and verified by the Chartered Accountant, must be given in such form, setting forth such particulars as prescribed by the Board. Rule 6G of the I.T. Act provides that such audit reports and particulars should be given in Forms No. 3CA/3CB as applicable, and the statement of particulars should be given in Form No. 3CD.

- For Salaried/SEP/SENP Co-applicant: Saving Bank statement should be up to 15 days before the login date.

- For Self Employed Professional/Non-Processional Co-applicant: Current/O.D. bank statement should be up to 30 days before the login date.

- Copy of PAN Card or Passport is compulsory for all Income Earning/Retired Co-applicants.

we will be happy to assist you further

We recommend that students secure their education financing as early as possible. Doing so not only helps avoid cramming and surprises at the last minute but also helps you focus on your college applications.

Confused about what comes first? University application or loan application?

The solution

Credila helps solve this problem by offering seamless loan sanctions, thus helping you:

Reduce the wait time to secure your seat

Reduce the wait time to secure your seatThe benefits of starting the loan application process early

Planning and preparation are key to avoiding last-minute surprises

A hassle-free procedure that it may help you secure admission in time.

Frequently Asked Questions

Don’t know where to start? We are here to help.

Our Students' Success Stories

Pay it forward!

Make your friends a part of the Credila community and help them fast-track their education loan process.

Refer a friend