Our education loans are trusted by

STUDENTS

COUNTRIES

INSTITUTES

Let's get started

)

) )

) )

)9 Ways your student loan works for you

Save time. Go online.

Customer-centric processes with just 3 steps to disbursement.

We cover it all

Up to 100% financing of tuition and cost-of-living.

Start with a secured future

Benefit from seamless loan sanctions.

Better rates. All the way.

Student loans with customised interest rates.

Dream big. Achieve bigger.

Need a loan of INR 1 crore or more? Not a problem.

Pan-India network of branches

Enjoy multi-city co-borrower(s) and collateral flexibility.

The benefit of tax saving

Added tax deductions that bring down your cost of financing.

Flexible payment plans

Repayment tenure of up to 15 years.

No hidden charges

What you see is what you pay.

Save time. Go online.

Customer-centric processes with just 3 steps to disbursement.

We cover it all

Up to 100% financing of tuition and cost-of-living.

Start with a secured future

Benefit from seamless loan sanctions.

Better rates. All the way.

Student loans with customised interest rates.

Dream big. Achieve bigger.

Need a loan of INR 1 crore or more? Not a problem.

Pan-India network of branches

Enjoy multi-city co-borrower(s) and collateral flexibility.

The benefit of tax saving

Added tax deductions that bring down your cost of financing.

Flexible payment plans

Repayment tenure of up to 15 years.

No hidden charges

What you see is what you pay.

Save time. Go online.

Customer-centric processes with just 3 steps to disbursement.

We cover it all

Up to 100% financing of tuition and cost-of-living.

Start with a secured future

Benefit from seamless loan sanctions.

Better rates. All the way.

Student loans with customised interest rates.

Dream big. Achieve bigger.

Need a loan of INR 1 crore or more? Not a problem.

Pan-India network of branches

Enjoy multi-city co-borrower(s) and collateral flexibility.

The benefit of tax saving

Added tax deductions that bring down your cost of financing.

Flexible payment plans

Repayment tenure of up to 15 years.

No hidden charges

What you see is what you pay.

Easy 3-step process

A simple and transparent journey.

Apply Online

Fill out the application form and upload documents.

Application Review

Get your sanction letter after our credit appraisal.

Funds Disbursed

You are all set to get started.

Key calculators to assist you

What's new

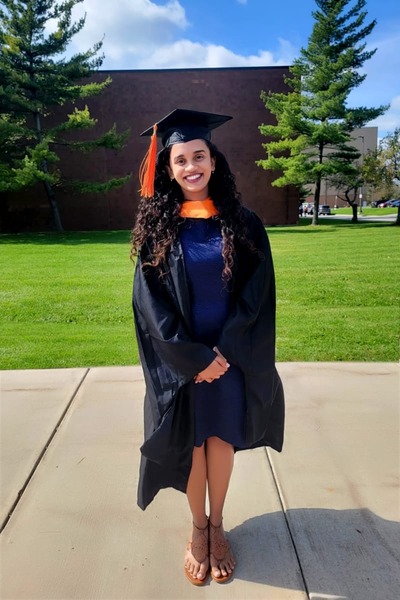

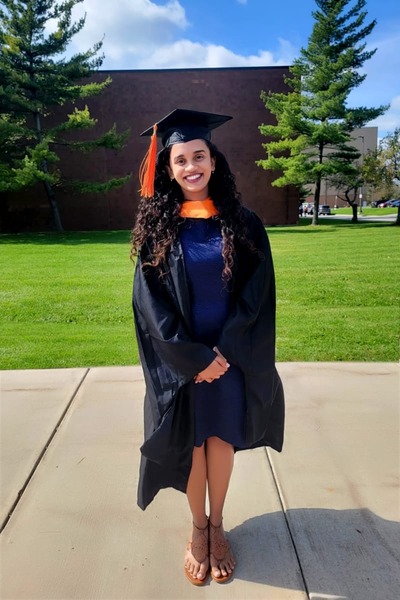

Our customer stories

Enabling life-changing experiences.

Shantanu Sachdeva

SIBM, Pune

Pune, India

Batch of 2022-'24

Anmol Agarwal

MSc - Data Science

International University of Applied Sciences (IUBH)

Berlin, Germany

Batch of 2024-'25

I must also commend the relationship managers, who were an integral part of my positive experience. Their dedication is a testament to Credila's commitment to excellence in customer service. Their support played a crucial role in making my educational journey smooth and successful, and I'm immensely grateful for their exceptional service."

Ameya Shahu

MSc – Computer Science

Arizona State University

Arizona

Batch of 2023-‘25

Abhinav Kshitij

MBA

University of Oxford

Batch of 2023-‘25

Nupur Neelanjan Moti

Graduate Certificate Program: Financial Services – Canadian Context

Algonquin College, Canada

Canada

Batch of 2022-‘24

Aditya Uday Bhosale

Master of Management in Agribusiness

Lincoln University, New Zealand

New Zealand

Batch of 2024-‘25

Richa Kandpal

Business Analytics (MSc)

University of Galway, Ireland

Ireland

Batch of 2024-2025

Monosij Banerjee

Master of Business Administration

Symbiosis Institute of Business Management, Pune

Pune, India

Batch of 2022-'24

Shantanu Sachdeva

SIBM, Pune

Pune, India

Batch of 2022-'24

Anmol Agarwal

MSc - Data Science

International University of Applied Sciences (IUBH)

Berlin, Germany

Batch of 2024-'25

I must also commend the relationship managers, who were an integral part of my positive experience. Their dedication is a testament to Credila's commitment to excellence in customer service. Their support played a crucial role in making my educational journey smooth and successful, and I'm immensely grateful for their exceptional service."

Ameya Shahu

MSc – Computer Science

Arizona State University

Arizona

Batch of 2023-‘25

Abhinav Kshitij

MBA

University of Oxford

Batch of 2023-‘25

Nupur Neelanjan Moti

Graduate Certificate Program: Financial Services – Canadian Context

Algonquin College, Canada

Canada

Batch of 2022-‘24

Aditya Uday Bhosale

Master of Management in Agribusiness

Lincoln University, New Zealand

New Zealand

Batch of 2024-‘25

Richa Kandpal

Business Analytics (MSc)

University of Galway, Ireland

Ireland

Batch of 2024-2025

Monosij Banerjee

Master of Business Administration

Symbiosis Institute of Business Management, Pune

Pune, India

Batch of 2022-'24

Shantanu Sachdeva

SIBM, Pune

Pune, India

Batch of 2022-'24

Frequently asked questions

Don’t know where to start? We are here to help.

Credila Financial Services Limited (Formerly known as HDFC Credila Financial Services Limited) is one of India’s largest education loan non-banking financial companies (NBFC). Credila provides education loans to Indian students to pursue higher education both in India and abroad.

Credila has funded 178,000+ Indian students across 64 countries in 4,600+ institutes*.

*As of March 31, 2024

Credila Financial Services Limited is one of India’s largest education loan non-banking financial companies (NBFC). Since inception, Credila has invested time and resources setting up appropriate systems, processes, and know-how related to the education industry. With a pulse on the education sector, Credila’s education loans have been designed to be student-centric, as they understand the challenges that students and their parents face.

Credila has offices across locations that include Mumbai, Pune, Nashik, Ahmedabad, New Delhi, Bengaluru, Chennai, Hyderabad, Kolkata, Bhopal, Bhubaneshwar, Chandigarh, Jaipur, Madurai, Surat, Vijayawada and Vishakhapatnam. We also have shared office spaces in Vadodara, Coimbatore, Indore and Nagpur.

With Credila’s multi-city flexibility, you can apply for an education loan from Credila from anywhere.

All you need to do is apply online via Credila’s website at www.credila.com. Following this, the Credila team will guide you through the education loan process.

Credila celebrates #MovingUp