Banks understand loans, but Credila understands students and their needs!

Students face many challenges while securing education loans. Some of the issues faced by students include:

- For students going to the USA, UK, Canada, Australia, etc. there are number of activities and formalities which take away the time. Running around from one branch to the other and doing multiple rounds for education loans get very difficult

- Flexibility in terms of loans which need to be customized to the requirements of the students and their respective courses

- Ability to find the required margin money (portion of the fees that is to be paid by students/parents which is not covered by the loan)

- Required loan amount is more than the value of the collateral security

- Ability to prove that the University, College and the applied Course is appropriate. (This can be quite challenging if the decision maker is not aware of the thousands of valid and accredited educational choices available in today's fast changing world of education)

- Ability to get web-based access to the loan account with web enabled transaction processing inclusive of electronic payments, etc.

Credila is a specialized lender for Education Loans. Credila has invested time and resources to set up appropriate systems, processes and know-how related to the education industry. Credila has numerous databases on education sector. Credila's credit scoring model for the approvals of loans is designed specifically for education loans.

Credila, therefore, understands problems, challenges and issues faced by the students and their parents. Credila's objective is to work closely with students and parents to try to identify the appropriate education loan programs for them.

- To get admission to the US Universities & to get I-20 for US visa, 'Availability of Liquid Funds' to complete the course needs to be demonstrated.

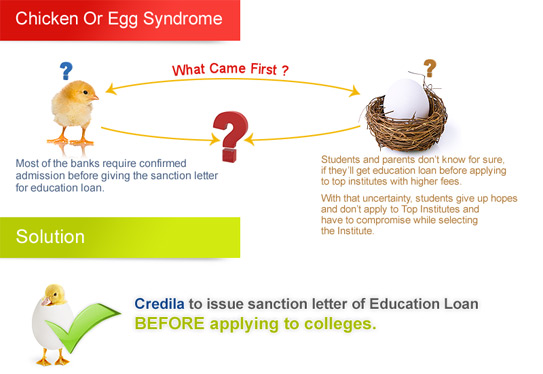

- Credila's "Education Loan Sanction Letter" before admission can help you show the availability of liquid funds.