Students face many challenges while securing education loans. Some of the issues faced by students include:

Credila is a specialized lender for Education Loans. Credila has invested time and resources to set up appropriate systems, processes and know-how related to the education industry. Credila has numerous databases on education sector. Credila's credit scoring model for the approvals of loans is designed specifically for education loans.

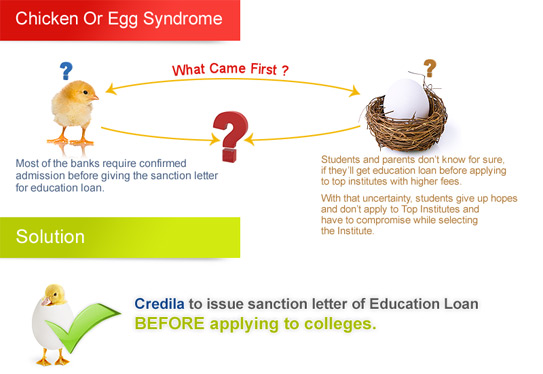

Credila, therefore, understands problems, challenges and issues faced by the students and their parents. Credila's objective is to work closely with students and parents to try to identify the appropriate education loan programs for them.

All parents dreams about the best possible higher education for their children. Funding the rising cost of education is becoming increasingly difficult. We provide education loan to fund up to 100% of cost of education.

Credila representative can visit you, understand your funding needs and get the process of education loan completed. Have one more option for education loan!

Save time and energy. Call us for a door-step service about your funding needs.